Introduction to The Essential Plan

In the heart of the bustling state of New York, The Essential Plan stands as a testament to the state’s commitment to providing affordable healthcare to its residents. This healthcare program is specifically designed for low to moderate-income individuals, filling the gap between Medicaid and private insurance. The Essential Plan is not just a health coverage plan; it’s a lifeline for many, ensuring that financial constraints do not bar access to necessary medical services.

Overview of The Essential Plan

The Essential Plan offers a range of health care services for a minimal fee, including doctor visits, inpatient and outpatient care, prescriptions, and more. Introduced under the Affordable Care Act, it serves those who do not qualify for Medicaid due to their income level but find private insurance financially out of reach.

Purpose and Benefits

The plan’s primary goal is to offer a safety net for those hovering above the Medicaid eligibility line, ensuring that more New Yorkers can receive the healthcare they need without the stress of overwhelming costs.

Eligibility Criteria for The Essential Plan in New York

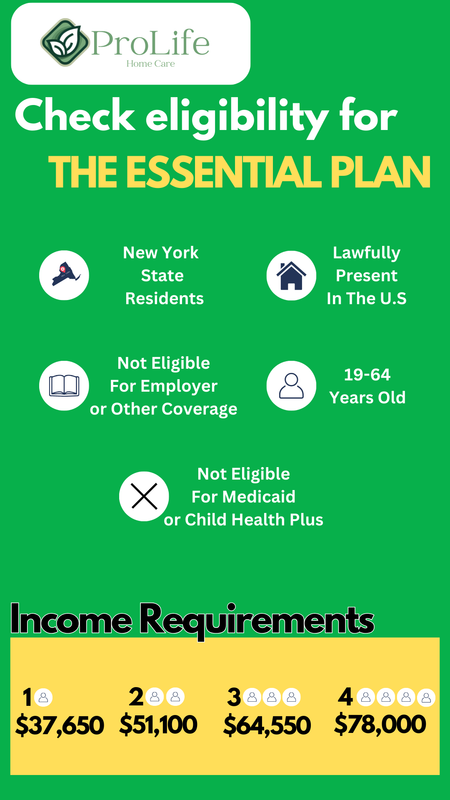

Determining eligibility for The Essential Plan is a critical first step for New Yorkers seeking affordable health insurance. The criteria are multifaceted, touching on residency, income, age, and other coverage statuses. It’s tailored to ensure that the plan serves those who are most in need of an affordable healthcare option without compromising the quality of coverage.

New York State Residency

The foundational eligibility criterion is New York State residency. Applicants must live in the state, but the definition of residency extends beyond mere physical presence. It encompasses the intention to maintain a permanent and primary home in New York. This criterion ensures that the benefits of the plan are reserved for individuals who are an integral part of the state’s community.

Lawfully Present in the U.S.

Applicants must be lawfully present in the United States. This includes U.S. citizens, nationals, permanent residents, and individuals with various other immigration statuses that are recognized by the U.S. government. This criterion aligns with federal guidelines and reflects New York’s commitment to serving its diverse population.

Age Requirement

Eligibility is also age-specific. The plan is designed for individuals who are aged 19-64. This age range captures a significant portion of the workforce, including young adults who are often in transition between school and work and older adults who may not have access to employer-sponsored health insurance or Medicare.

Lack of Affordable Employer or Other Coverage

The Essential Plan is a safety net for those who do not have access to affordable health insurance through an employer or other programs. If you have the option of employer-sponsored insurance but the costs are prohibitive, or if the coverage is inadequate, you may still qualify for The Essential Plan.

Income Requirements

Income is perhaps the most quantifiable criterion for eligibility. The plan caters to individuals and families who earn too much to qualify for Medicaid but still find it challenging to afford private insurance. The income requirements are set at a level that aims to help those who fall into this coverage gap.

The provided image outlines the income limits based on household size, which are as follows:

- For a household of 1: the maximum income is $37,650.

- For a household of 2: the maximum income is $51,100.

- For a household of 3: the maximum income is $64,550.

- For a household of 4: the maximum income is $78,000.

These numbers are based on a percentage of the Federal Poverty Level (FPL) and are subject to change with annual updates to the FPL.

Gathering Required Documents

Prepare the necessary documentation for the application process. This may include:

- Proof of identity (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Proof of residency (e.g., utility bills, rental agreement)

- Proof of your immigration status if you are not a U.S. citizen

Applying for The Essential Plan in New York can be done through several channels:

- Online: You can apply by visiting the New York State of Health Marketplace website at nystateofhealth.ny.gov. Once there, you’ll need to create an account and fill out the application form with the required information.

- In-Person: If you prefer to apply in person, you can find a navigator or certified application counselor in your area to assist with the application process. They offer help free of charge. For finding local help, navigate to the Find Local Help section on the NY State of Health website.

- By Phone: If you would like to apply over the phone, you can call the New York State of Health Customer Service Center at 1-855-355-5777 (TTY: 1-800-662-1220). The customer service center operates Monday through Friday from 8:00 AM to 8:00 PM and on Saturday from 9:00 AM to 1:00 PM.

- By Mail: You can also request a paper application form from the New York State of Health Customer Service Center, complete it, and mail it back. To obtain the paper form, you can call the customer service center using the number provided above.

Not Eligible for Medicaid or Child Health Plus

The Essential Plan is not available to those who are eligible for Medicaid or Child Health Plus. These programs are designed for individuals and families with even lower income levels, and thus, they offer a different structure of benefits and coverage. The Essential Plan acts as a bridge for those who exceed Medicaid income thresholds but still need support.

Exclusion Criteria

Understanding who the plan is not for is as important as knowing who it is for. Individuals who are already covered by another plan, such as Medicaid, Medicare, or employer-sponsored insurance, are not eligible for The Essential Plan. This ensures that the program efficiently allocates resources to those in need of this specific coverage.

In summary, the eligibility criteria for The Essential Plan reflect New York’s commitment to providing affordable healthcare to a broad segment of its population. By considering factors like income, residency, age, and other coverage options, the state aims to fill the gap in healthcare coverage and provide a robust safety net for its residents. It’s an initiative that acknowledges healthcare as a fundamental need and seeks to ensure that fewer New Yorkers face the vulnerability of being uninsured.

Coverage and Benefits of The Essential Plan in New York

The Essential Plan, available to qualified New York residents, offers a substantial array of healthcare services. This affordable health insurance plan ensures that beneficiaries have access to vital medical care without the financial burden often associated with private insurance plans. Here, we delve into the extensive coverage and the benefits that enrollees can expect.

Health Services Provided

The Essential Plan covers a comprehensive suite of healthcare services that aim to maintain, improve, and protect the health of enrollees. Coverage includes but is not limited to:

- Primary Care Visits: Enrollees have access to a primary care provider (PCP) who oversees their health care, provides illness and injury care, and manages chronic conditions.

- Specialist Visits: When specialized care is required, the plan covers visits to specialists for conditions that require more targeted expertise.

- Preventive Care: Critical to maintaining good health, preventive services such as vaccinations, screenings, and wellness visits are covered without additional costs.

- Hospitalization: Coverage extends to inpatient hospital care, providing the necessary treatments and services during a hospital stay.

- Emergency Services: In situations requiring urgent medical attention, the plan covers emergency room visits and emergency transportation.

- Laboratory Services: Diagnostic services including blood tests, urinalysis, and other lab work are covered under the plan.

- Prescription Drugs: The plan includes a formulary of covered prescription medications, ensuring access to necessary drugs with minimal out-of-pocket costs.

- Maternity and Newborn Care: From pregnancy through postpartum care, the plan supports mothers and newborns with comprehensive services.

- Mental Health Services: Recognizing the importance of mental health, the plan covers counseling, therapy, and other mental health services.

- Substance Abuse Treatment: Services for substance abuse treatment, including detoxification and outpatient programs, are included.

- Rehabilitative Services: For those recovering from an injury or illness, rehabilitative services such as physical therapy are covered.

- Preventive Dental and Vision Care: Some versions of the Essential Plan include preventive dental and vision care, promoting overall health.

Additional Benefits

Beyond the standard medical services, the Essential Plan provides several additional benefits that contribute to the holistic well-being of its members:

- Telehealth Services: As healthcare evolves, the plan offers coverage for telehealth services, allowing members to access care remotely.

- Low or No Premiums and Deductibles: The plan is designed to be affordable, with low or no monthly premiums and no deductibles, reducing the financial barriers to accessing healthcare.

- Low Out-of-Pocket Costs: Copayments for doctor visits and other services are minimal, making it easier for members to seek care when needed.

- Language Assistance: For non-English speakers, the plan provides language assistance services, ensuring that all members have the resources to effectively communicate with healthcare providers.

- Support Services: Some enrollees may have access to additional support services such as care coordination, which can be especially beneficial for those with chronic conditions or complex healthcare needs.

The Essential Plan’s coverage and benefits are structured to ensure that enrollees can access a wide range of healthcare services without the stress of high costs. It embodies New York’s commitment to its residents’ health and well-being by removing financial barriers to necessary care. This comprehensive approach to coverage not only supports the immediate healthcare needs of New Yorkers but also invests in their long-term health outcomes.

Cost and Affordability of The Essential Plan in New York

The Essential Plan, a program under the New York State of Health marketplace, is lauded for its affordability and is designed to make health care accessible to a wider demographic of New Yorkers. The cost structure of this plan is one of its most compelling attributes, offering significant financial relief when compared to standard health insurance policies.

Monthly Premiums

One of the standout features of The Essential Plan is its very low monthly premium. For eligible individuals, the monthly costs can range from zero to a modest fee, depending on income levels. This is a fraction of the cost of the premiums for typical private health insurance plans, making The Essential Plan a highly attractive option for its target demographic.

- Individuals at the lower end of the income scale: For those making just above the Medicaid income limits, the Essential Plan often has no monthly premium. This means qualified individuals can receive comprehensive health coverage without any monthly cost.

- Individuals with slightly higher incomes: Those with incomes slightly higher may encounter a modest monthly premium. For example, a person earning around $22,000 per year might pay a monthly premium of around $20 for the Essential Plan.

- Individuals near the top of the income eligibility range: As income approaches the upper eligibility limit for the Essential Plan, the monthly premium might increase, but it remains significantly lower than premiums for comparable coverage in the private market. For instance, an individual earning close to the maximum income threshold for a single person, which was noted as $37,650, might pay a monthly premium in the range of $40 to $60.

Out-of-Pocket Maximums

The plan also protects members from high medical costs throughout the year with an out-of-pocket maximum. This is the most a member would have to pay for covered services in a plan year. Once they spend this amount on deductibles, copayments, and coinsurance, the health plan covers 100% of the costs of covered benefits.

Cost-Sharing Reductions

For individuals and families who are at the lower end of the income eligibility scale, cost-sharing reductions (CSRs) are applied. CSRs lower the amount you have to pay for deductibles, copayments, and coinsurance, thus making health care costs more manageable for those with limited financial resources.

No Hidden Fees

The Essential Plan is transparent with its costs, which means there are no hidden fees or unexpected charges. Enrollees can confidently access healthcare services knowing exactly what their financial responsibilities will be.

Comparison with Other Plans

When compared to other insurance plans available on the marketplace, The Essential Plan often emerges as the most cost-effective choice for eligible individuals. It provides essential health benefits that are on par with other plans but at a fraction of the cost, making it an essential asset for its members.

Conclusion

In conclusion, The Essential Plan in New York is designed to provide comprehensive healthcare coverage at an affordable cost for eligible residents. While it includes a vast array of services, certain exclusions apply, as with any health insurance plan. These often include non-essential, elective, or cosmetic procedures, as well as experimental treatments not recognized by the FDA. For detailed information on coverage limitations, beneficiaries should consult the latest documents provided upon enrollment or directly engage with customer service representatives.

Frequently Asked Questions (FAQs) about The Essential Plan

- What medical services are typically not covered by The Essential Plan?

- The Essential Plan may not cover services that are considered non-essential, elective, or cosmetic. It also might not cover experimental treatments or medications that are not FDA-approved.

- How can I find out if a specific treatment is covered by The Essential Plan?

- To find out if a specific treatment is covered, you can review your Summary of Benefits document, visit the New York State of Health website, or call the Customer Service Center at 1-855-355-5777 for the most current information.

- Are prescription drugs covered under The Essential Plan?

- Yes, prescription drugs are generally covered under The Essential Plan, but there may be some exceptions or formulary limitations.

- Can I receive dental and vision care through The Essential Plan?

- The Essential Plan does offer dental and vision care coverage, often with no additional premium or cost-sharing. However, it’s important to check the specifics of your plan as benefits may vary.

- Is there a period when I cannot enroll in The Essential Plan?

- No, there is no limited enrollment period for The Essential Plan. Eligible individuals can apply at any time during the year.

Leave a Reply